We'll now take a look at the process for automating our trades directly from our strategy.

As we have seen, the principle of automation is based on three stages, which we will learn to set up in detail later on:

- Our strategy, which runs on TradingView according to our settings and sends alerts to our intermediary

- Our intermediary, who manages the automation of our trading orders, receives these alerts and transforms them. into concrete orders for our broker

- Our broker, who manages our portfolio (our money) and our trades, receives trading orders from our intermediary and executes them.

Opening an account with WunderTrading

Our own experience of trading and automation finally led us to WunderTrading as the intermediary between our strategy and our broker. Their site is flexible, readable and reliable, and the programming of the bots is simple and functional. In several years of use, there have been no execution problems. What's more, although it's not the subject of this training, they also offer the possibility of creating other types of bots, such as grid bots. with backtest. Finally, they allow you to use many different brokers which, if you don't use BitGet as we encourage newcomers to the world of trading to do, is also a considerable advantage.

To start with, you can create a free account, and then switch from one paid account to another according to your needs. The difference between the different packages is essentially the number of bots you can program.

1 - Visit WunderTrading

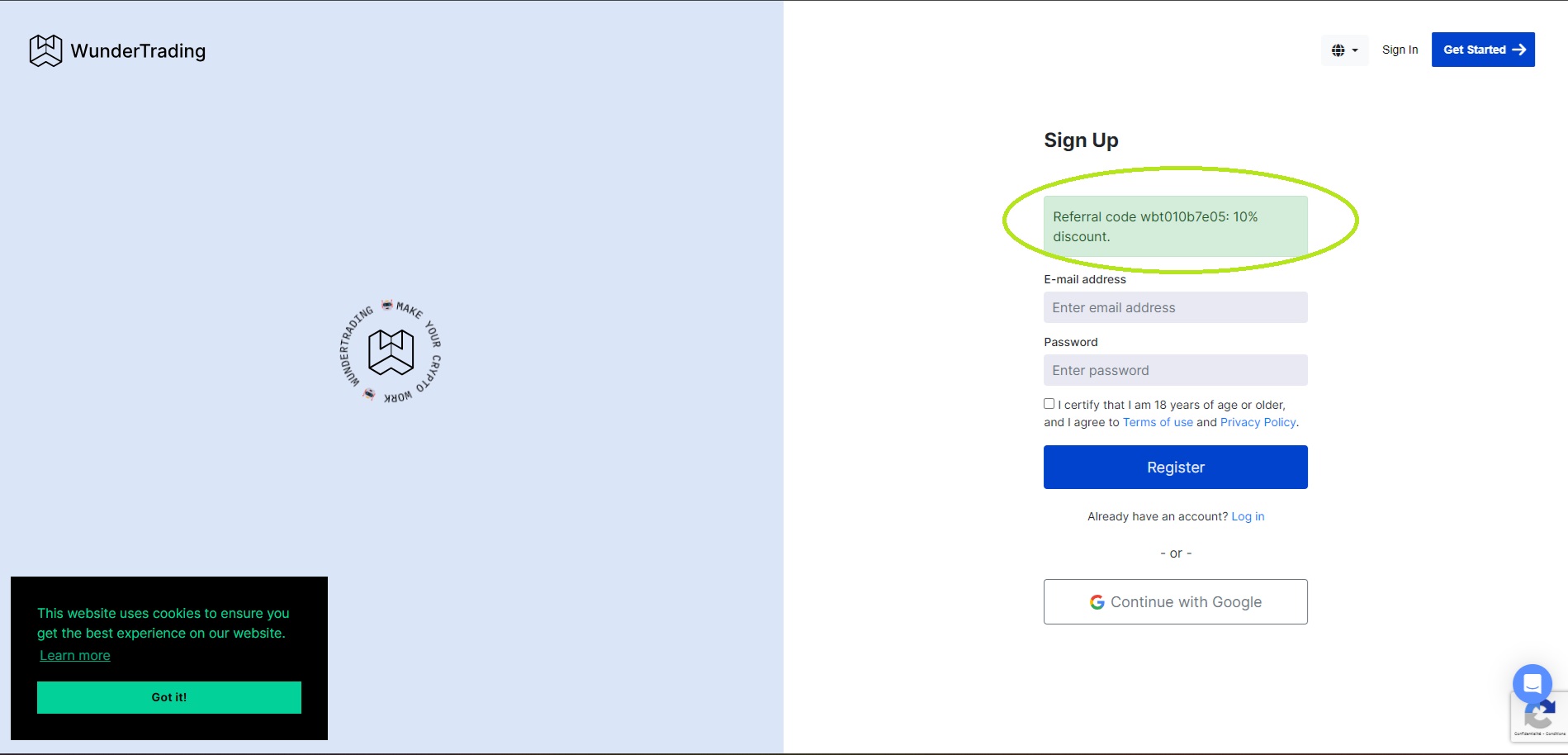

The link below offers 30 % on annual subscriptions and 10 % on monthly subscriptions. The first paying plan (4.5 $ to date) is enough to get you started on setting up your first trading robots.

- Register with WunderTrading (30 % on annual subscriptions and 10 % on monthly subscriptions)

2 - Fill in your e-mail address, choose a password, validate the conditions and then confirm.

If you used the link above, your discount on paid packages has been activated.

3 - A verification link has been sent to your mailbox

4 - Go to your e-mail inbox and click on the validation link

5 – You can activate the demo mode (we'll learn how to create new ones manually).

When you register, a 7-day trial period with the "Pro" package will be activated.

6 - Presentation of the different plans in relation to our automation needs

Later in the course, we'll look at three approaches to strategy management and capital utilization.

- The "Bon père de famille" approach with the TopBot Premium strategy does not require a single bot for optimum performance

- As for the "Winrate 100%" and "Aggressive strategy" approaches, to optimize your capital, you'll need 15 bots or more.

You can always start with the cheapest plan, program your first bot and then change plans, or if you want to optimize your trading from the outset (with the WinRate 100% strategy we'll be talking about), you can start directly with the pro plan.