We're going to set up our first trading bot in Paper Trading mode, but even if you want to start with real trading (not recommended), the whole process is the same and we won't go back over the points explained here.

For this example, we'll take the strategy in its full version, but the process is the same for the LITE version (in which case you'll only use the "Enter_Long and Exit_Long" functions).

At the end of the chapter, we'll talk about how to find new assets and settings yourself, but to avoid getting bogged down, we'll start with the following assets and settings for this first bot:

LITE version :

L3USDT.P - BITGET - 5M - LONG - Backtest : 03/09/2024 - 09/11/2024 - CASH : 500 (1/2 Equity By Entry - x2 Leverage) - SMA Lenght : 33 - Exit Deviation : 0.004 - LONGS : 0.029 - 0.04 : Stop-Loss - 100% (none)

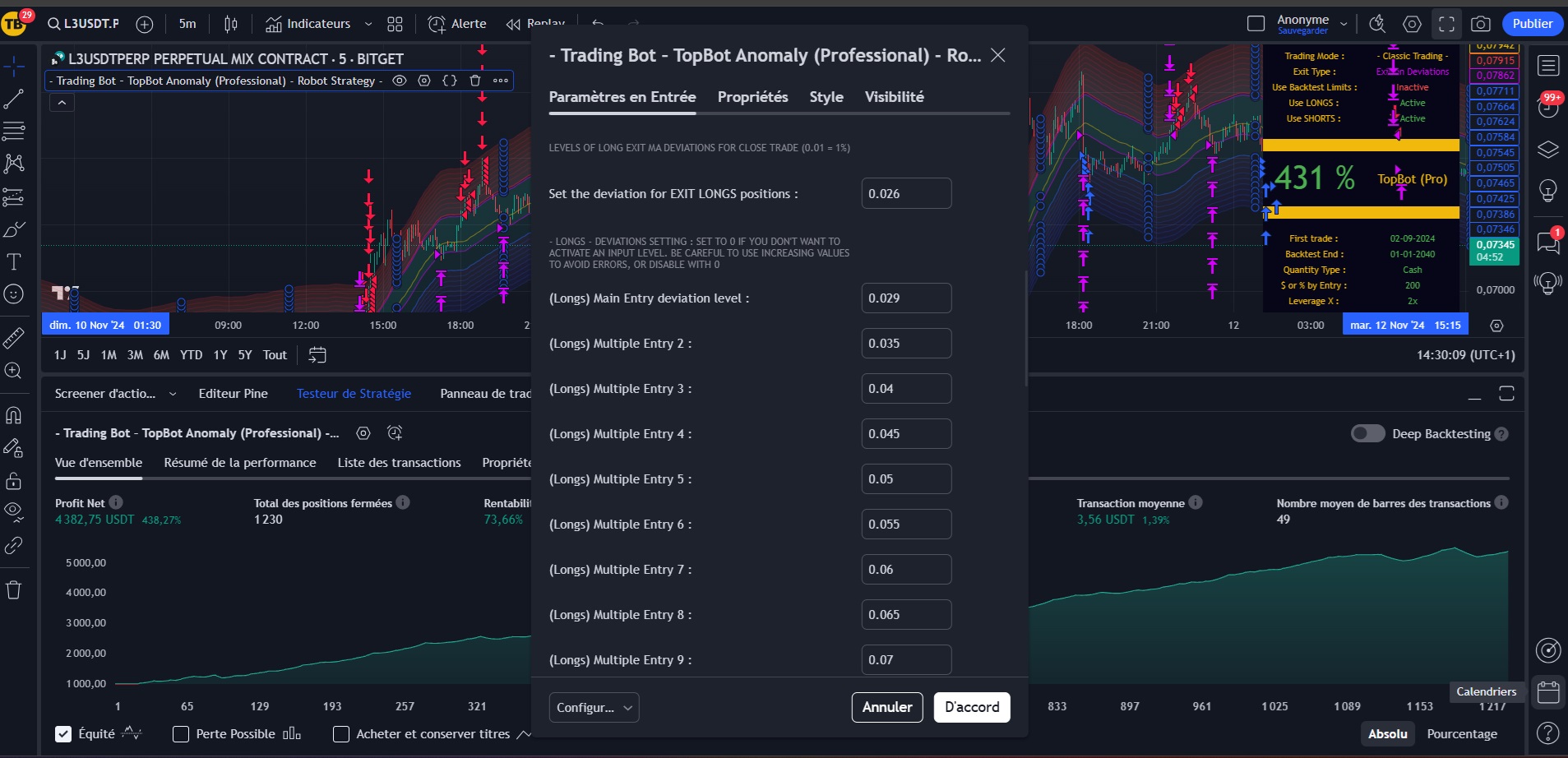

PRO version (Classic Trading mode) :

- L3USDT.P - BITGET - 5M - SMA Lenght: 33 - Trading Mode: LONG & SHORTS (Exit by Deviations) - SL-LONGS: 100% - SL-SHORTS: 100% -

- EXIT LONG : 0.026 - LONGS : 0.029 - 0.035 - 0.04 - 0.045 - 0.05 - EXIT SHORTS : 0.1 - SHORTS : 0.028 - 0.035 - 0.04 - 0.045 - 0.05 -

- Amount: PERCENT (avaliable balance, 20 %, Leverage 2x (1/5 Equity By Entry for 5 positions each side) - Backtest: 03/09/2024 - 03/11/2024 -

1 - Load the strategy onto your chart, choose the right asset and timeframe, and set the parameters as indicated.

2 - On WunderTrading, create a new signal bot

3 - Set up your bot

- Bot name We advise you to give the same name to your bot and to your TradingView alert. What's more, we recommend that when you have several robots running simultaneously, you indicate in the name: Asset - Timeframe - Broker - Type of strategy applied.

- Optional description for you

- If the option is enabled, your bot will run Paper Trading on the demo account you select in (4) and (5).

- Choose your broker

- Choose the api of the account (paper trading or real) on which the bot is to place its orders

- Choose the TimeFrame (this has no impact on the strategy and its execution, but will help you find your way around)

- Select the asset you wish to trade (only assets present on the selected broker will be available here)

- Leave TradingView

- For our strategies we use orders MARKET (we buy or sell regardless of the price at the time of the order)

- Choose type of amount for position entry In % of your available balance or in monetary value. This is the amount that will be played each time a new position is entered. The advantage of a fixed amount is that all positions will have the same "Weight" in the result, the disadvantage is that you need to update the amounts regularly to make the most of your capital. TopBot Anomaly allows you to test both types of amount directly from the strategy. At the end, choose the one that suits you best.

- Choose amount per entry If you have selected "Position size" in (10), this will be % of available capital per entry, if you have selected "Fixed amount" this will be a fixed value in $.

- Leverage adjustment : IMPORTANT: The leverage set here is valid ONLY for paper trading. If you place orders on a real account, you must set your leverage. directly on BitGet, from your account, on the chosen asset, in the USDT-M trading interface.This point will be covered in detail later in the course, but don't neglect it, as the default leverage on bitget is x20 and your account can be liquidated! We recommend maximum leverage of x1 or x2 for long-term risk management.

- Select "Multiple entries and Exit All for the classic trading strategy. For Swing-Trading mode, select only the "Swing-Trading" option, as this mode uses only one position entry at a time.

- Exit All will close all positions in the same direction on receipt of a single output signal. Always use this option for multi-position inputs.B

- If you use the "Swing-Trading" mode in your strategy settings, activate this function and deactivate (13) and (14).

- We don't use TakeProfit with our strategies

- We do not use trailing stops with our strategies.

- Set StopLoss (per open position). Optional in Classic Trading mode, it is recommended for swing trading. You can try out different stop-loss levels directly in your strategy's backtest. Note that for Classic Trading, we advise you to leave this option deactivated. even if you use stop-losses in your strategy because exit orders will be sent directly from the strategy if the stop-loss is reached. However, in swing-trading, the strategy cannot send exit orders (only reversal orders), and this is where you need to set a stop-loss (which will be the same for longs and shorts).

- Webhook address : Indispensable, to be configured in the notification settings of your tradingview alert. We'll come back to this point in more detail below.

- "Alert message": This is the text you enter in the "Message" section of your TradingView alert. The strategy will then automatically replace the message with the appropriate order and send it to your trading bot.

- Enter-Long: Message to be copied to TopBot Anomaly strategy parameters. This is the command to open a LONG position.

- Exit-Long: Message to be copied to TopBot Anomaly strategy parameters. This is the command to close a LONG position.

- Enter-Short: Message to be copied to TopBot Anomaly strategy parameters. This is the command to open a SHORT position.

- Exit-Short: Message to be copied to TopBot Anomaly strategy parameters. This is the command to close a SHORT position.

Note: You'll notice that in "Swing-Trading" mode (15) only the "Enter-Long" and "Exit-Long" messages are available. An Enter-Long will close the Short position already opened and enter the Long position, and vice-versa.

On your web browser, keep a tab open with Trading-View and your strategy settings, and a tab open with WunderTrading and your bot settings.

4 - Enter position entry and exit orders in your strategy parameters

To get started, go to your bot's settings on WunderTrading, copy Enter Long

Switch to your Trading-View strategy settings and paste the signal in the appropriate place

Do the same for EXIT_LONG and, in the Pro version, for ENTER_SHORT and EXIT_SHORT.

Please note! Be sure to delete any pre-existing content before pasting your signal to avoid generating problems and to ensure the integrity of your signal message.

5 - Validate your strategy settings

6 - Create a strategy alert

- To create an alert (now that your strategy is in place and configured), you need to be on strategy tester / overview / click on alarm clock / fill in name and paste message

- Use the same name for both the alert and the bot (recommended for easy identification).

- In the "Message" section, copy and paste : {{strategy.order.comment}}

Don't validate your alert yet, we'll need to configure the "Notifications" tab.

7 - Configure the WebHook for your alert

Still in your alert, click on the "Notifications" tab and tick "Webhook URL" and paste https://wtalerts.com/bot/trading_view (available in your bot on WunderTrading)

Optional: You can receive additional notifications on your phone or computer by selecting other settings. Only the Webhook is important for our trading bots.

Click on the "Create" button to validate your alert

Your alert is now programmed and you can view it in the "Alerts" tab on the right of the screen:

8 - Confirm the creation of your bot on WunderTrading

Go back to your Bot settings tab on WunderTrading and validate the bot creation.

WunderTrading will ask you what you want to do. Click on "Save and wait for the signal".

Congratulations! Your first bot is now programmed! As soon as the strategy conditions have been met, a suitable order will be sent to your bot, which will then place the order on your broker (in this case, the demo account).

We'll see in later sections how to set up a real API account to trade with real money, but the process (by simply unchecking the "Paper Trading" box) is absolutely the same.

9 - IMPORTANT: If your bot is trading with real money in your account: Set leverage on BitGet

Leverage set in the bot at WunderTrading is for guidance only (except for Paper Trading). To ensure that your actual leverage is the one you decided on, before or just after creating your strategy, go to your Bitget account and follow the instructions below:

This action must be made for each asset separately!

- Select your bot's asset (top left) then

- Set margin to "Isolated" (top right)

- Set leverage to x1 (recommended, depending on your risk management) or x2 (maximum for experienced traders).

There's nothing to save or record, as BitGet remembers your settings. When your bots move into position, they'll apply the leverage you've just selected.

10 - Important notes

- Once you have programmed an alert on TradingView, the configuration at the time of the alert is saved. in your alert. You can then close the strategy or use it with another program without affecting the alert you have programmed.

- By hovering your mouse over the alert name, you'll see the settings specific to your strategy at the time the alert was created. This may allow you to program the same settings again, for a follow-up of your strategy for example.

- If you wish to change the settings of your already programmed strategy, you need to delete the old alert, make your new settings, enter the corresponding bot signals and re-create an alert.

- Be careful not to forget change bot signals each time you program a new alert. Signals are stored in the alert along with the strategy settings.

- Depending on your TradingView account level, alerts can have an end date. Set yourself a reminder one day in advance to renew them, or upgrade to a higher version of TradingView for alerts without deadlines.

- As long as your tradingview alert and WunferTrading bot are activated, the strategy will monitor the market and place orders automatically. If you no longer want a particular bot, simply delete your alert on TradingView and your corresponding bot on WunderTrading.

In the following chapters we'll look at how to set up a real account (on BitGet), transfer funds and create an API for long-term trading.